37+ is mortgage insurance tax deductable

For married couples filing separately if each partner earns. 8 2019 California Representative Julia Brownley introduced the Mortga See more.

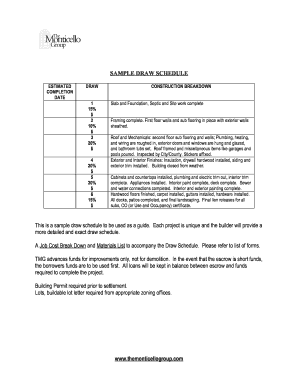

37 Free Editable Construction Schedule Templates In Ms Word Doc Pdffiller

Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses.

. Web If your adjusted gross income for the year is 109000 or more youre not qualified for a PMI deduction. And lets say you. Web Read about the Mortgage Insurance Tax Deduction Act of 2017.

Web FHA mortgage insurance is subject to some different lender rules than conventional mortgage insurance but is treated the same for tax purposes. Web Private mortgage insurance is tax deductible for all tax years until and including the year 2021 but it may not always be a good idea to deduct PMI premiums. Web Homeowners who have sufficient mortgage interest and other qualified expenses to get above the standard deductions of 25900 married filing jointly or 12950 single or.

So lets say that you paid 10000 in mortgage interest. Web The mortgage insurance premium deduction is not permanent in the tax code but it has been extended every year since 2006. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web This deduction allows you to claim the total amount paid toward your mortgage interest within one year. Web Mortgage insurance premiums are typically paid monthly and they can be included in the borrowers monthly mortgage payment. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Once your income rises to this level the. However higher limitations 1 million 500000 if married. Also your adjusted gross income cannot go over 109000.

Home equity loans and cash-out. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

ITA Home This interview will help you. Homeowners can deduct the interest paid on the first. Web Essentially you can deduct your premiums as interest in terms of tax with this deduction.

Ad Taxes Can Be Complex. Ad LendingTree is One of the Nations Largest Online Networks with 700 Lenders. Web Mortgage Insurance Premiums you paid for a home where the loan was secured by your first or second home may qualify for the.

The Tax Relief and Health Care Act first introduced the deduction for mortgage insuCongress then stepped in again. This income limit applies to single head of. Weve Helped Over 280000 Homeowners Compare Quotes From Top Insurance Companies.

The Bipartisan Budget Act of 2018 extended the mortgage insurance premiums deduction retroactively again through 2017. Web That means this tax year single filers and married couples filing jointly can deduct the interest on up to 750000 for a mortgage if single a joint filer or head of. Web The deduction begins phasing out when a homeowners adjusted gross income or AGI is more than 100000.

Web Web Is mortgage insurance tax-deductible. We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Mortgage Insurance premiums are.

Free 37 Loan Agreement Forms In Pdf Ms Word

Free 37 Sample Claim Forms In Pdf Excel Ms Word

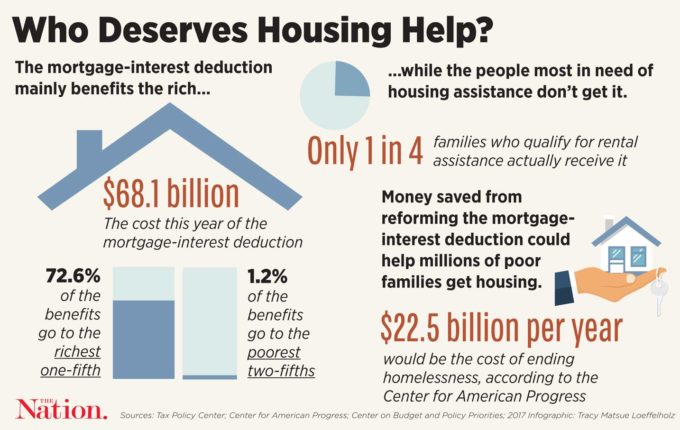

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Home Mortgage Loan Interest Payments Points Deduction

Is Pmi Mortgage Insurance Tax Deductible In 2022 Refiguide Org Home Loans Mortgage Lenders Near Me

5 Types Of Private Mortgage Insurance Pmi

Is There A Mortgage Insurance Premium Tax Deduction

Jpmc3q13exhibit991

Is Mortgage Insurance Deductible In 2021

Mortgage Interest Tax Deduction What You Need To Know

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Vystar Credit Union Review High Interest Rates On Cds

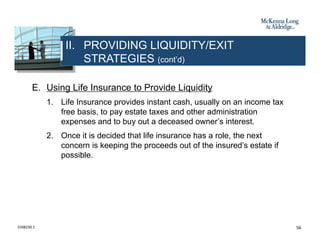

Business Succession Planning And Exit Strategies For The Closely Held

What Expenses Can Be Deducted From Capital Gains Tax

Free 37 Sample Claim Forms In Pdf Excel Ms Word

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation